north dakota sales tax refund

Select the North Dakota city from the list of popular cities below to see its current sales tax rate. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return.

Form 40 Qr 28755 Download Fillable Pdf Or Fill Online Application For Quick Refund Of Overpayment Of Estimated Income Tax For Corporations North Dakota Templateroller

North Dakota has recent rate changes Thu Jul 01 2021.

. North Dakota Offi ce of State Tax Commissioner PO Box 5527 7013281241 taxregistrationndgov Bismarck ND 58506-5527 TDD. Written Determinations Sales and Use Tax. Gross receipts tax is applied to sales of.

The sales tax is paid by the purchaser and collected by the seller. Office of State Tax Commissioner. Please Do Not Write In This Space Mail to.

With local taxes the total sales tax rate is between 5000 and 8500. North Carolina Department of Revenue. North Dakota sales tax is comprised of 2 parts.

Refunds Things to Know. PO Box 25000 Raleigh NC. Municipalities can also charge local sales tax.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically. Amended Returns and Refund Claims. ST - Sales Use and Gross Receipts Tax Form North Dakota Office of State Tax Commissioner I declare that this return has been examined by me and to the best of my knowledge and belief is a true correct and complete return.

Sales and Use Tax Revenue Law. The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov. Up to 10 cash back With TaxSlayer preparing and e-filing your North Dakota tax refund is quick and easy.

Attach additional sheets if necessary. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 35. Ad A brand new low cost solution for small businesses is here - Returns For Small Business.

Each receipt must include 2500 or more in taxable merchandise excluding tax. Form 301-EF - ACH Credit Authorization. Tax Year 2021 only.

Download Complete Form ND-1 for the appropriate Tax Year below. When calculating the sales tax for this purchase Steve applies the 50 state tax rate for North Dakota plus 05 for Cass countys tax rate and 20 for Fargos city tax rate. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more.

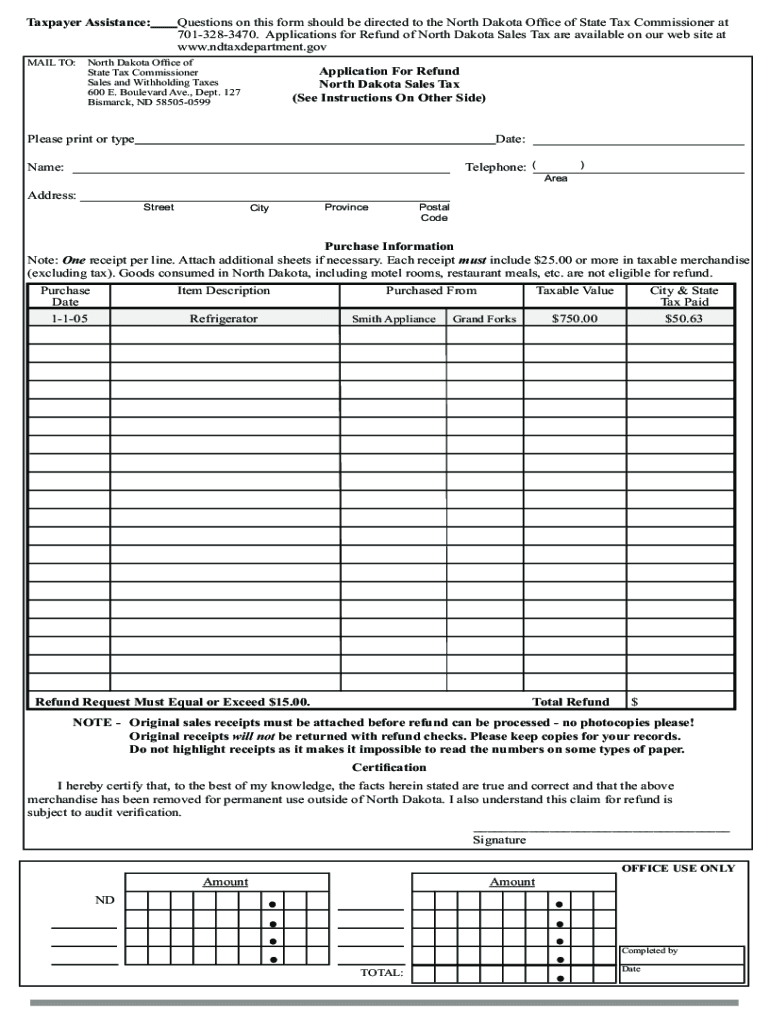

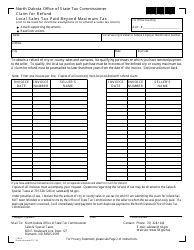

127 Bismarck ND 58505-0599. Please note that if you file your North Dakota sales taxes by mail it may take significantly longer to process your. Tax Paid Purchase Item Description Date North Dakota Office of State Tax Commissioner Application For Refund North Dakota Sales Tax - Canadian Resident Name City Postal Code Purchase Information Note.

Register to collect and remit sales tax in all Streamlined States. The state sales tax rate in North Dakota is 5000. How can we make this page better for you.

That means the effective rate across the state can vary substantially with the combined state and local rate in some places reaching 85. Sign the form and submit it by mail to. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

The statewide sales and use tax in North Dakota is 5. Refund Applied to Debt North Dakota participates in income tax refund offset which provides that an individual income tax must be applied to reduce a debt you may owe to a state or federal agency. To qualify for a refund Canadian residents must be in North Dakota specifi cally to make a purchase and the goods purchased must be removed from North Dakota within 30 days of purchase for use permanently outside of North Dakota.

17643 40 of the businesses registered through the SSTRS contract with a CSP as of 3312022 Important. New farm machinery used exclusively for agriculture production at 3. Currently combined sales tax rates in North Dakota range from 5 to 8.

At a total sales tax rate of 75 the total cost is 37625 2625 sales tax. How to File Sales and Use Tax Resources. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

Generally speaking if you spent more than 2500 in sales tax to a single vendor in the past year your purchase qualifies for a refund. North Dakota first adopted a general state sales tax in 1935 and since that time the rate has risen to 5. Tax Commissioner Reminds Taxpayers of Extension Deadline.

Direct Deposit If your bank refuses a direct deposit of a refund we will mail a paper check to you at the address listed on your return. As a result the total sales tax can be as much as 85 in some parts of the state. Furthermore refunds are available only on taxable purchases of 2500 or more.

127 Bismarck North Dakota 58505-0599. Sign Mail Form ND-1 to the address listed above. North Dakota sales tax payments.

Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. A claim for refund must be filed with the North Dakota Office of State Tax Commissioner Sales and Special Taxes 600 E. Form 306 - Income Tax Withholding Return.

You are responsible for collecting and remitting sales tax to each state beginning with your registration date. Ndgov Cory Fong Tax Commissioner NNoticeotice Sales Tax Request For Refund - Canadian Resident May 5 2009 In recent months the Tax Department has received a considerable number of sales tax refund. Sales Use and Gross Receipts Tax Return to the following address.

100 W Cypress Creek Road Suite 930-A Fort Lauderdale FL 33309 Map Directions. Find IRS or Federal Tax Return deadline details. Get everything done in minutes.

North Dakota Office of State Tax Commissioner Sales and Special Taxes 600 E. North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a. By making use of signNows comprehensive platform youre able to perform any necessary edits to North Dakota tax refund for Canadian residents form.

North Dakota State Income Taxes for Tax Year 2021 January 1 Dec. North Dakota Sales Tax Refund. North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0959 on.

North Dakota also imposes sales tax at a rate of 7. The claim for refund must include copies of all invoices to support the claim. Taxpayers may also file North Dakota sales tax returns by completing and mailing Form ST.

Office of State Tax Commissioner PO Box 5623 Bismarck ND 58506-5623. One receipt per line. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

With the launch of the new website also comes the release of the 2021 North Dakota income tax booklets and income tax forms and the 2022 income tax withholding tables. The state sales tax rate for most purchases of tangible personal property in North Dakota is 5 and local governments can impose their own taxes as well. Tobacco Tax Refund Inc.

When done Print Sign and Mail in - not eFile - Your Tax Amendment Address Change etc.

North Dakota Sales Tax Small Business Guide Truic

Form Sfn 21854 Certificate Of Purchase Exempt Sales To A Person From Montana

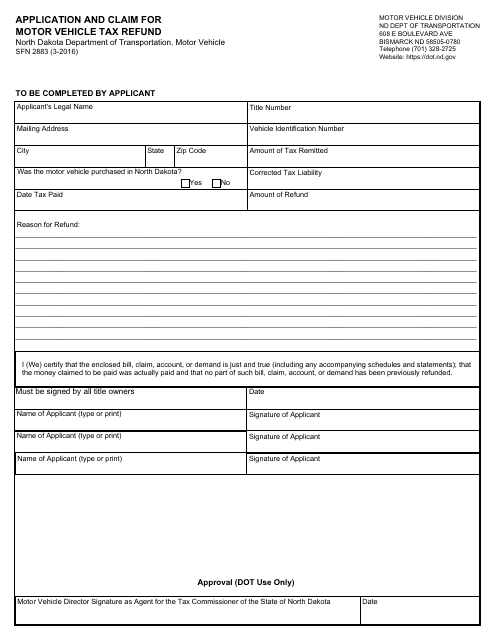

Form Sfn2883 Download Fillable Pdf Or Fill Online Application And Claim For Motor Vehicle Tax Refund North Dakota Templateroller

Income Tax Update Special Session 2021

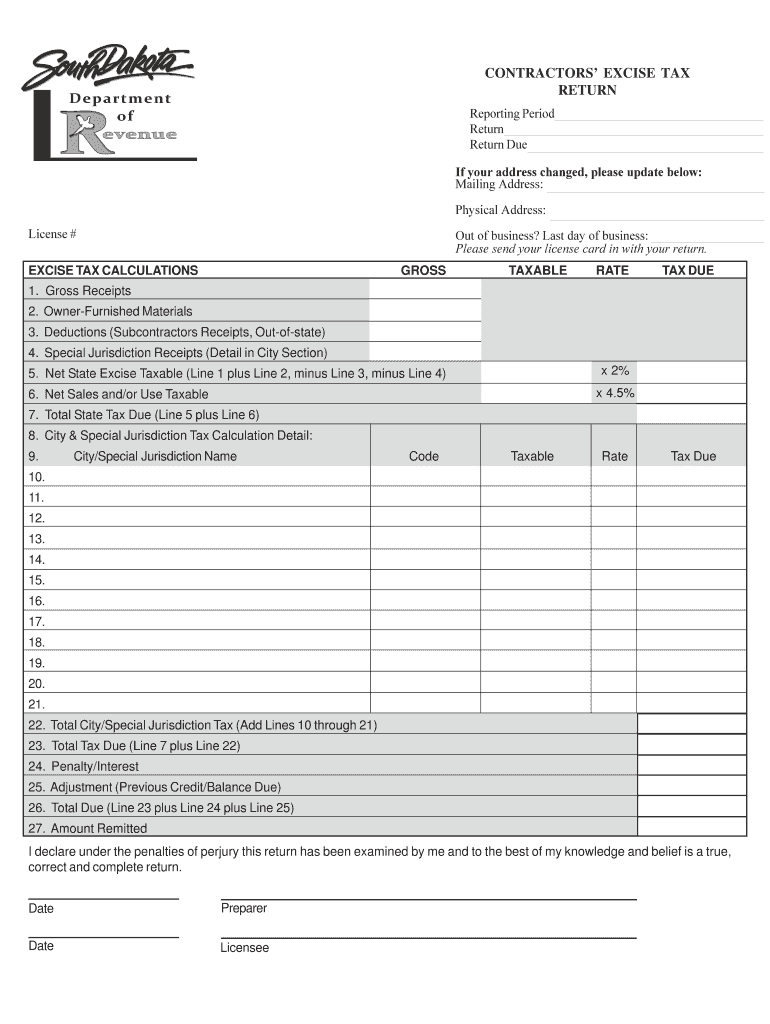

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

How To File And Pay Sales Tax In North Dakota Taxvalet

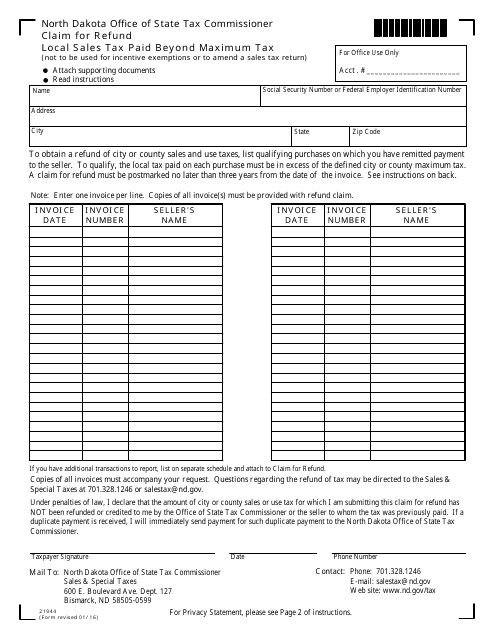

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

Where S My Refund Of North Dakota Taxes

File North Dakota Taxes Get A Fast Tax Refund E File Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/7M6VPWRWYRAXRFDSIX3GNG2KDE.jpg)

Committee Advances Bill Requiring State Motto Seal At South Dakota Schools

North Dakota Tax Refund Fill Out And Sign Printable Pdf Template Signnow

Where S My North Dakota State Tax Refund Taxact Blog

Ndtax Department Ndtaxdepartment Twitter

North Dakota Tax Refund Fill Online Printable Fillable Blank Pdffiller

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

North Dakota Tax Forms And Instructions For 2021 Form Nd 1

How To File And Pay Sales Tax In North Dakota Taxvalet

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller